Since generative AI began its ascension with the launch of ChatGPT almost two years ago, I’ve been focused on the opportunities that the technology presents to publishers … not just for a distant, idealized future, but for current, everyday needs. Tools like Mirabel’s Media Mate are already helping.

I see today’s products and tomorrow’s possibilities as reason enough to explore and embrace the technology now, but I of course appreciate the many factors that businesses weigh before diving in and investing for the future.

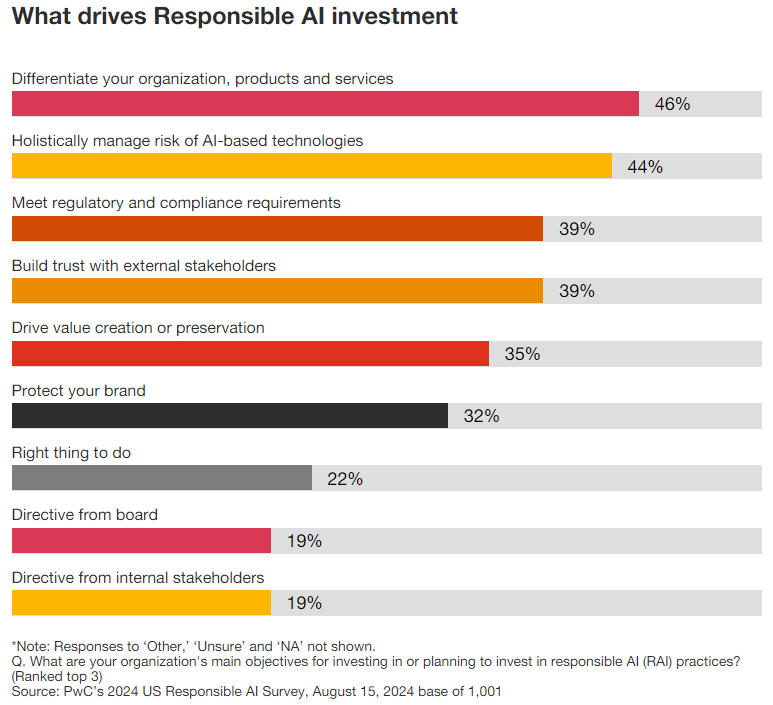

A recent PwC survey asked business and tech execs what objectives drive their responsible AI investments (or plans to invest), with the top response (46%) being to differentiate their organization, product, or service. 44% ranked “holistically manage risk of AI-based technologies” in their Top 3, followed by 39% with “meet regulatory and compliance requirements” and 39% with “build trust with external stakeholders.”

(Source: PwC)

“[Leaders] are beginning to realize what it takes to build and deploy AI solutions that not only drive productivity and business transformation but also manage risk and preserve the incremental value that these solutions create,” PwC says in its survey overview. “As AI continues to advance and redefines the nature of work and innovation, success requires sustained focus and a holistic view of the risks and the opportunities to build AI solutions responsibly.”

Of the benefits achieved by investing in responsible AI practices, 41% see enhanced customer experience, 40% see enhanced cybersecurity and risk management, and 39% see facilitated innovation. As for investment barriers, the top factor facing companies from investing is the difficulty in quantifying risk mitigation from a responsible AI program (29%).

“A standardized framework to document assessment of risks, responses and ongoing monitoring can help address this challenge,” the report says. “It should consider both AI’s inherent risks and those that may remain after you have made informed choices that match your risk appetite. It should also document that mitigations have not only been designed and assessed but that their ongoing effectiveness has been demonstrated.”

SEE FOR YOURSELF

The Magazine Manager is a web-based CRM solution designed to help digital and print publishers manage sales, production, and marketing in a centralized platform.